The Task Force on Climate-related Financial Disclosures (TCFD) recommendations recommend all companies to make disclosures around four areas: governance, risk management, strategy, and metrics and targets. The OLC Group discloses climate-related information based on the four areas of disclosures of the TCFD recommendations.

|

Source: “Recommendations by the Task Force on Climate-related Financial Disclosures (Final Version)” by the Task Force on Climate-related Financial Disclosures (TCFD)

- Processes by which the Board of Directors is informed about climate-related issues; the frequency at which the Board of Directors considers issues; the subjects of monitoring

Considering climate change as one of the important issues for sustainability management and with the Risk Management Committee identifying the relevant climate-related issue as a strategic risk, the Corporate Strategy Planning Department, which oversees strategic risks, designates the supervisory organization of the relevant risk and checks the progress of responses. The Sustainability Promotion Committee chaired by the President reports and assesses the progress of examining strategic risks on a regular basis, after which the Corporate Strategy Planning Department holds discussions and makes resolutions at the Executive Committee. The Board of Directors receives reports on the discussions and resolutions of the Executive Committee at least once a year, and discusses and oversees material sustainability issues, including climate change. - Responsibility of management in climate-related issues; processes by which management receives reports; monitoring methods

The President, who chairs the Sustainability Promotion Committee, is responsible for management decisions related to sustainability, including climate change. The specifics of the discussions by the Sustainability Promotion Committee are submitted by the Corporate Strategy Planning Department to the Executive Committee for resolution and ultimately reported to the Board of Directors.

- Details of processes for identifying and assessing climate-related risks; how materiality determinations are made

The Sustainability Promotion Committee examines sustainability risks, including climate change, in further detail, and discusses the materiality and assessment of the risks. Each supervisory organization incorporates the initiatives related to the relevant risks into the implementation plan through the examination of strategic risks and the process of medium-term management plan formulation. The specifics of the discussions in which the progress was checked by the Sustainability Promotion Committee are submitted by the Corporate Strategy Planning Department to the Executive Committee for resolution and ultimately reported to the Board of Directors.

- Details of processes for managing material climate-related risks; method of prioritizing climate-related risks

Based on a recognition that risks and opportunities accompanying climate change have a large impact on business strategies, such risks and opportunities are identified and their materiality assessed through the following process:

|

1. Extract |

2. Identify, assess |

3. Manage |

|---|

|

|

|

- How processes for identifying, assessing, and managing climate-related risks are integrated into the OLC Group’s overall risk management

The OLC Group establishes and operates a risk management cycle to formulate risk prevention and response measures against individual risks in accordance with the OLC Group Risk Management Guidelines. After the Risk Management Committee chaired by the President extracts, identifies, and assesses overall risks pertaining to the OLC Group’s business activities and classifies the risks as strategic risks or operational risks, each supervisory organization narrows down the risks that should be given priority. The supervisory organizations formulate and implement preventive measures and countermeasures against climate change, which is considered an especially material strategic risk. The responses of the measures are checked by the Corporate Strategy Planning Department, which oversees strategic risks. The results of the checks are shared by the Corporate Strategy Planning Department with the Sustainability Promotion Committee on a regular basis for assessment and discussion of countermeasures. The results are reported to the Executive Committee and the Board of Directors once a year and reflected in the OLC Group’s strategy under the supervisory system of the Board of Directors.

- Details of short-term, medium-term, and long-term climate-related risks and opportunities

While we aim for sustainability management, which realizes both “contribution to a sustainable society” and “maintaining of long-term corporate growth,” we believe that the risks and opportunities pertaining to sustainability, including climate change, may affect our business activities. Thus, we are making efforts to mitigate and adapt to climate change with a target of achieving “Net zero GHG by 2050.” We are considering devising a medium- to long-term business strategy that coincides with the time horizons of the “Net zero GHG by FY2050” target, since the impact of climate change materializes over a long period of time.

|

Period |

Definition |

|---|

|

Short term |

Until FY2027 |

The period covered by the KPIs for 2027 in the Company’s ESG Materiality |

|---|

|

Medium term |

Until FY2030 |

The period covered by the KPIs for 2030 in the Company’s ESG Materiality |

|---|

|

Long term |

Until FY2050 |

The period covered by the 2050 net zero GHG emissions target |

|---|

- A description of and degree of the impact of the risks and opportunities on the business, strategy, and financial planning

- Risks, opportunities, and financial impact based on related scenarios, and strategies and resilience to the risks and opportunities

We carried out a scenario analysis for the first time in FY2021 for the purpose of understanding the risks and opportunities posed to the OLC Group by climate change and the impact thereof and examining the OLC Group’s strategy and resilience as well as the need for further measures, simulating the world in 2050. The scenario analysis was based on the following three scenarios, based on several existing scenarios released by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC).

|

4℃ scenario |

Temperatures rise by around 4℃ compared to pre-industrial levels as a result of lack of action on global warming that exceeds current actions. |

|---|

|

2℃ scenario |

The rise in temperatures is restricted to around 2℃ compared to pre-industrial levels as a result of strict actions on global warming. |

|---|

|

1.5℃ scenario |

The rise in temperatures is restricted to less than 1.5℃ compared to pre-industrial levels at a high probability as a result of a fundamental shift of the system. |

|---|

With regard to our business activities in FY2022 onward, we plan to examine the OLC Group’s strategy and resilience after analyzing the impact of climate change based on the above scenarios and considering countermeasures. The outline of risks and opportunities, and the business and financial impact of the three scenarios is as follows.

Note: The following only includes those deemed to have a large impact based on both qualitative and quantitative assessments of the business and financial impact, including changes in customers’ values, which are hard to quantify. We will continue to reassess the risks on a regular basis, utilize the opportunities, and consider countermeasures as a strategic issue. The degree of impact of the risks is rated qualitatively at two levels: “Max” and “Large.”

- Max: Risks and opportunities expected to have an extremely large impact on the OLC Group’s business and finance

- Large: Risks and opportunities expected to have a large impact on the OLC Group’s business and finance

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

- Metrics used to manage climate-related risks and opportunities

- Greenhouse gas emissions (Scope 1, 2, 3)

- Targets used to manage climate-related risks and opportunities and performance against targets

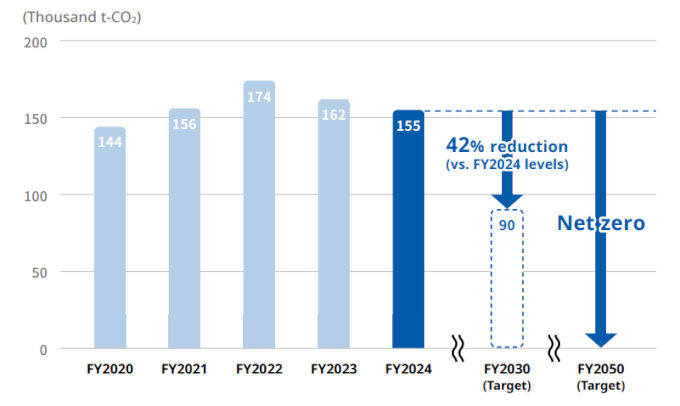

We recognize that the reduction of GHG emissions is key in addressing climate change risks. Based on this recognition, we promote measures to mitigate and adapt to climate change. For Scope 1 and 2, we have set targets in line with the Japanese government’s reduction targets and the policies for each industry formulated by the Japanese government.

*Medium- and long-term Scope 1 and 2 GHG emissions targets: “Net zero by FY2050” “42% reduction (vs FY2024 levels) by FY2030”

*The actual and target Scope 1 and 2 GHG emissions are as follows.

Scope1 and 2 -The OLC Group

*Scope 2 emissions are calculated based on the market-based method.

Scope 3 -The OLC Group