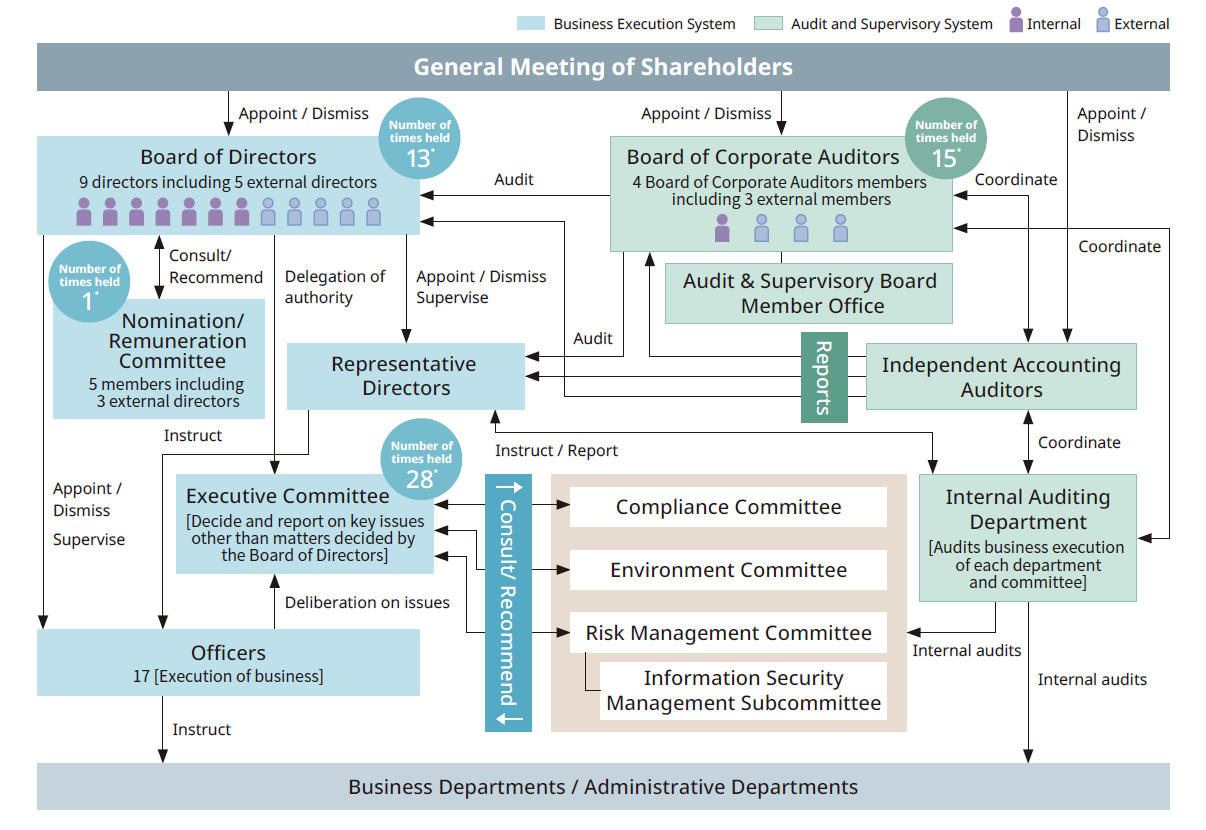

We will continue working to strengthen corporate governance, based on our understanding of the importance of raising management transparency and fairness, achieving sustainable growth and development and fulfilling our social responsibilities. Specifically, we aim to strengthen corporate governance, by reinforcing the internal control system, increasing management transparency, and promoting the reinforcement of management oversight functions. By conducting honest management that emphasizes corporate ethics through these measures, we aim to increase our corporate value.

We have introduced a corporate officer system to develop a more robust group management control system and ensure corporate governance in accordance with changes in the environment surrounding our business.

This clarifies the supervisory and executive responsibilities in each business of our Group and enables directors to focus on supervision, thereby bolstering the management’s supervisory function and encouraging the delegation of the task of business execution to corporate officers, which leads to further expeditious decisions being made.

The directors and corporate auditors check the management of our company from their respective perspectives. The directors carry out deliberations in accordance with the basic policies of management while ensuring that there are no breaches of laws and the Articles of Incorporation. Furthermore, to promote timely and appropriate decision-making, our company has established the Executive Committee, chaired by the CEO, as an organization to decide or report on important matters concerning the execution of duties delegated by the Board of Directors (excluding matters to be resolved by the Board of Directors under the Rules of Administrative Authority). Furthermore, our company has established an optional Nomination/Remuneration Committee as an advisory body to the Board of Directors. The majority of its members are made up of independent external executive directors.

* Actual results for FY2024

|

|||||||||||||||||||||||

*1 The maximum number of directors defined in the Articles of Incorporation is 15.

*2 Representative Director Toshio Kagami was appointed.

*3 The maximum number of Board of Corporate Auditors members defined in the Articles of Incorporation is 6.

To enhance the transparency of the Board of Directors and further strengthen management structure, the Board of Directors comprises 9 directors, including 5 external executive directors, making up over 50% of the board, and discusses and makes decisions on important items.

Board of Directors meetings are attended by both standing and part-time corporate auditors, who offer opinions. The directors and corporate auditors, who have different duties, monitor management from their own unique perspectives.

- Matters related to the General Meeting of Shareholders (determination of proposals for voting)

- Matters related to quarterly and annual operating results and financial reports, and forecasts for the next period

- Matters related to the personnel affairs of executive directors and corporate officers (director candidates and responsibilities of directors and corporate officers)

- Matters related to the effectiveness of the Board of Directors

- Matters related to examination of cross-shareholdings

- Matters related to the OLC Group Long-term Management Strategy

- Matters related to the revision of our Group’s ESG Materiality

- Report on the operating status of our Group’s internal reporting system and risk management system

- Report on the progress regarding our Group’s ESG Materiality

- Report on the FY2023 activities of the Corporate Conduct Committee

- Report on the FY2023 activities of the Environment Committee

- Matters related to the entry into a new business (cruise business) and the conclusion of a licensing agreement pertaining to the new business, among others

According to changes around the business environment, our Group has introduced the Corporate Officer System to accelerate decision-making by promoting the delegation of authority to corporate officers.

The Board of Directors delegates authority to the Executive Committee, which is chaired by the CEO and comprises Standing Board of Corporate Auditors members and corporate officers. The Committee discusses, decides on, and reports on important items pertaining to business execution (excluding items requiring a Board of Directors resolution). Furthermore, standing corporate auditors can also attend and offer opinions.

The Board of Corporate Auditors comprises four corporate auditors, of whom three are external corporate auditors. Based on the Auditing Policies and the Auditing Plans, the Board of Corporate Auditors members listen to reports from executive directors, officers, and employees, while reporting on the status of deliberation at important meetings, audit results, and other matters, engaging in mutual discussions The two Standing Board of Corporate Auditors members attend and express their views at meetings of the Board of Directors, the Executive Committee, and other committees to monitor the process of important decision-making and execution of duties.

Furthermore, to assist the corporate auditors in their duties, employees who are independent from directors and the business execution divisions are assigned as staff, and the effectiveness of corporate auditing is also enhanced through cooperation between the corporate auditors, independent accounting auditors, and the Internal Auditing Department.

A voluntary Nomination / Remuneration Committee, which is chaired by the Chair of the Board of Directors and includes a majority of independent external executive directors, has been established as an advisory body to the Board of Directors. The goal is to enhance the independence and objectivity of the functions of the Board of Directors related to executive director nomination, remuneration, and other such matters. The committee deliberates on the validity of the nominations and remuneration of executive directors and Board of Corporate Auditors members (including draft proposals on these for the General Meeting of Shareholders), as well as succession plans, and then reports to the Board of Directors. Decisions on individual remuneration amounts for executive directors are entrusted to the committee by the Board of Directors.

During FY2024, the Nomination / Remuneration Committee met once, with the following members in attendance: Toshio Kagami, Committee Chair, Representative Director, and Chair of the Board of Directors; Yumiko Takano, Representative Director, Chairperson and CEO; Tsutomu Hanada, Executive Director (External); Yuzaburo Mogi, Executive Director (External); and Misao Kikuchi, Executive Director (External). The committee deliberated the draft proposal for the General Meeting of Shareholders on the election of executive directors and the draft proposal on the election of representative directors and senior executive directors, among others.

Furthermore, the committee resolved the amount of remuneration provided to individual executive directors, as tasked by the Board of Directors, and also reported on matters concerning the CEO/COO succession plans.

The OLC Group regards the development of next-generation management talent to be a management issue of paramount importance. It is also considered to be a key initiative in the ESG Materiality area of “Robust management foundation.” We therefore strive to establish a next-generation human resources development system to continue to enhance our corporate value, and are working toward the following KPI for 2030: “A system for securing a pool of talent is in place, facilitating the execution of succession plans.” Specifically, we are working to identify the requirements expected of managerial talent and, in partnership with our top management, to align these requirements with the actual progress we have made in talent development to enhance its effectiveness. In addition, we offer training programs to help future leaders to acquire the qualities and skills essential for management in an effort to operate the management talent development cycle, thereby developing and expanding the pool of leadership talent available to us.

We have in place an Internal Auditing Department to ensure compliance with laws and internal rules as well as efficient business execution. From an objective standpoint, the Department examines, assesses, and advises on whether Company operations are being conducted appropriately and efficiently in compliance with management policies and plans as well as internal regulations for the purpose of promoting management efficiency and contributing to enhanced profitability. The results of internal audits are reported to the President of the Company, as well as at the Board of Directors meeting and Board of Corporate Auditors meeting to enhance coordination among parties concerned. Furthermore, depending on the audit subject, the Department reports the audit results to the Risk Management Committee and Compliance Committee, among others, and directly raises issues and proposes improvement measures to the audit subject with the aim of enhancing internal control on an ongoing basis.

To ensure accurate accounting, we receive audits from KPMG AZSA LLC. Our designated unlimited liability and engagement partners from KPMG AZSA LLC are certified public accountants Noriaki Habuto and Ryoma Dodo. Additionally, a total of 32 accountants and assistants engage in other accounting and auditing activities (As of July 1, 2025).

OLC maintains an oversight system through the appointment of external officers to strengthen supervisory functions. The external executive directors give advice and make suggestions to the Board of Directors as necessary to ensure the validity and appropriateness of the decisions made by the Board of Directors. They also offer prudent advice based on their wealth of experience, wide-ranging insights, and outside perspectives, further enhancing management’s ability to maintain fairness.

The external Board of Corporate Auditors members consistently cooperate with Standing Board of Corporate Auditors members to share information required to oversee and supervise corporate management. In addition, they receive reports on the results of the independent accounting auditor’s year-end reviews and audits of the Company’s financial statements for the first to third quarters. They also exchange opinions regarding the Company’s operations as necessary while remaining well versed in a variety of Company-related information. Furthermore, the external corporate auditors cooperate with the Internal Auditing Department, a department conducting internal audit, in conducting audits by checking the internal audit plans in advance, and directly receiving the report on the internal audit results at the Board of Corporate Auditors meetings on a regular basis or at any time.

Every fiscal year, OLC’s Board of Directors analyzes and evaluates the effectiveness of the Board of Directors as a whole, using the results of the evaluation sheets distributed to and collected from each executive director and Board of Corporate Auditors member as part of evaluation material. In FY2023, as in the preceding fiscal year, the evaluation sheets were tallied and analyzed with support from an external organization. Each executive director and Board of Corporate Auditors member evaluated and provided input on the operation of and discussions at the Board of Directors, as well as the efforts made by the executive directors, external directors, and themselves. The results have indicated that these factors of the Board of Directors are generally appropriate and sufficient. Having deliberated on the effectiveness of the Board, the Board of Directors have concluded that it is being run appropriately and that its effectiveness has been ensured.

|

||||||||||||||||||||||||||||||

The Company’s Board of Directors decides on the policy regarding decisions on the content of remuneration for individual executive directors and Board of Corporate Auditors members (hereinafter, the “Decision Policy”), after consulting with the Nomination / Remuneration Committee on its draft policy. Decisions on remuneration for executive directors are entrusted to the Nomination / Remuneration Committee by the Board of Directors. Remuneration shall be decided within the limits determined by resolution at the General Meeting of Shareholders, after assessing the degree of achievement of management targets, the degree of achievement of targets for individual directors, and the contributions of individual directors to the Company, so that such remuneration serves as a sound incentive to drive sustainable growth. Said remuneration shall be paid periodically in cash and stock. However, external executive directors are paid remuneration in cash only.

The remuneration of Board of Corporate Auditors members is paid on a monthly basis in the form of cash in a fixed amount in principle in view of their roles and independence, in consideration of their position to pursue their duties regardless of the corporate operating results.

The Board of Directors has determined that the decisions regarding the content of individual directors’ remuneration are in line with the Decision Policy, because the Nomination / Remuneration Committee made the decision after considering the content from multiple perspectives, including consistency with the Decision Policy.

The remuneration of individual Board of Corporate Auditors members is determined through discussion by the members within the limit resolved at the General Meeting of Shareholders, after the validity of the levels, among other elements, has been affirmed by the Nomination / Remuneration Committee.

The upper limit for cash remuneration was set at ¥80 million (not including the employee portion) per month, as approved at the 39th General Meeting of Shareholders held on June 29, 1999. The payment of performance-linked remuneration to directors (excluding external directors) started from FY2024 within the limit for cash remuneration, as approved at the Board of Directors meeting held on February 26, 2024.

The upper limit for restricted stock remuneration (external executive directors are ineligible) was set at ¥100 million or 10,000 shares per year, as approved at the 58th General Meeting of Shareholders held on June 28, 2018. (However, due to a stock split conducted on April 1, 2023, the upper limit is currently 50,000 shares per year.) In addition, the introduction of the Board Benefit Trust-Restricted Stock (BBT-RS) program as a share-based remuneration program for directors (excluding external directors) was resolved at the 64th General Meeting of Shareholders held on June 27, 2024. It was also resolved that the total number of points per fiscal year to be granted based on the program would be no greater than 50,000 points, with such points converted at a rate of one common share of the Company per point when the Company’s shares, etc. are provided. Due to the introduction of the BBT-RS program, the Company has abolished the framework for restricted stock compensation, and has not since allocated any new restricted stock based on the system.

The upper limit for corporate auditor remuneration was set at ¥15 million yen per month, as approved at the 64th General Meeting of Shareholders held on June 27, 2024.

|

|||||||||||||||||||||||||||||||||||

Notes

1. The above table includes one Corporate Auditor who retired as of the conclusion of the 64th General Meeting of Shareholders held on June 27, 2024.

2. Employee wages are not paid to directors serving concurrently as employees.

3. The above amount of share-based remuneration represents the expenses pertaining to restricted stock remuneration and Board Benefit Trust-Restricted Stock (BBT-RS) that were posted during the fiscal year.

4. The Company has introduced the performance-linked remuneration as part of cash remuneration and the BBT-RS as share-based remuneration for the purpose of incentivizing directors to sustainably enhance the Company’s corporate value and further promote shared value between directors and shareholders. Prior to receiving the shares, the directors conclude a transfer restriction agreement with the Company, which restricts them from transferring or disposing of the shares until resignation. Due to the introduction of the BBT-RS program, the Company has abolished the framework for restricted stock compensation, and has not since allocated any new restricted stock based on the system.

5. The Company has abolished executive bonuses. The amounts paid to directors do not include executive bonuses.

6. In order to strengthen the independence and objectivity of the Board of Directors, the amount of remuneration for each director is determined at the discretion of the “Nomination/Remuneration Committee” (consisting of Toshio Kagami, Representative Director, Chairperson of the Board of Directors; Yumiko Takano, Representative Director, Chairperson and CEO; Tsutomu Hanada, External Executive Director; Yuzaburo Mogi, External Executive Director; and Misao Kikuchi, External Executive Director).

The Company believes in the need for long-term and amicable relationships with companies related to its business to drive sustainable growth and advances in the core Theme Park Segment. We maintain cross-shareholdings only in companies deemed to contribute to the deepening of mutual ties and enhancement of our corporate value. We will reduce such cross-shareholdings when said objectives cannot be met over the medium to long term.

Every year at the Board of Directors meeting, we carefully examine individual cross-shareholdings in terms of the appropriateness of the purpose for retention, the benefit associated with the holding (asset value, dividends, transactions, etc.), and whether or not the risk is commensurate with the capital cost, to determine the viability of the cross-shareholding.

When exercising voting rights on listed shares held, the Company shall make judgments on each agenda item from the following perspectives.

- Will the holding enhance the corporate value of the investment target over the medium to long term and lead to greater shareholder returns?

- Is there a risk that the holding will significantly damage share prices due to a major violation of laws or regulations, antisocial acts, scandals, or other inappropriate activities committed by the investment target?

- Has there been significant and prolonged stagnation in performance by the investment target?

- Is there a possibility that the holding will harm the common interests of shareholders?

|

Name/Position |

Nomination / Remuneration Committee |

Expertise and experience (skill matrix) |

||||||||

|

Corporate Management Top Management |

Finance/ Accounting |

Legal/Compliance/ Risk Management |

Human Resources/ Labor |

Marketing/ Sales |

IT/ Digital |

ESG |

Theme Park Segment |

|||

|

Toshio Kagami Representative Director, Chairperson of the Board of Directors |

● |

● |

● |

● |

● |

● |

● |

● |

||

|

Yumiko Takano Representative Director, Chairperson and CEO |

● |

● |

● |

● |

● |

|||||

|

Wataru Takahashi Representative Director, President and COO |

● |

● |

● |

● |

● |

● |

||||

|

Yuichi Kaneki Executive Director |

● |

● |

● |

|||||||

|

Tsutomu Hanada Executive Director (External, independent) |

● |

● |

● |

● |

● |

● |

● |

|||

|

Yuzaburo Mogi Executive Director (External, independent) |

● |

● |

● |

● |

● |

● |

||||

|

Kunio Tajiri Executive Director (External, independent) |

● |

● |

● |

● |

● |

● |

● |

|||

|

Misao Kikuchi Executive Director (External, independent) |

● |

● |

● |

● |

● |

|||||

|

Koichiro Watanabe Executive Director (External, independent) |

● |

● |

● |

● |

● |

● |

||||

The Company regards the expertise and experience in the following areas to be the basic skills required by executive directors to conduct corporate management with the aim of achieving sustainable growth and increasing corporate value over the medium- to long-term: Corporate management / top management, finance/accounting, legal/compliance/risk management, human resources/labor, marketing/sales, IT/digital, ESG, and Theme Park Segment (business), which is of particular importance in view of our business characteristics. The above skill matrix shows the expertise and experience of individual executive director.

[Risk]

Decreased growth opportunities and social trust due to lack of appropriate decision-making function

[Opportunities]

Strengthening management foundation by developing and securing a pool of next-generation management talent

Ensure that all laws and regulations and the Corporate Governance Code are complied with, and establish management systems that allow flexible responses to changes and facilitate growth.

|

||||||||

The attendance status of directors and corporate auditors with regard to Board of Directors meetings held during FY2024 was as follows.

|

Name and title |

Attendance status |

|

|

Toshio Kagami |

Representative Director |

12/13 |

|

Yumiko Takano |

Representative Director |

13/13 |

|

Kenji Yoshida |

Representative Director |

13/13 |

|

Yuichi Katayama |

Executive Director |

13/13 |

|

Wataru Takahashi |

Executive Director |

13/13 |

|

Yuichi Kaneki |

Executive Director |

13/13 |

|

Rika Kanbara |

Executive Director |

13/13 |

|

Tsutomu Hanada |

Executive Director (External) |

13/13 |

|

Yuzaburo Mogi |

Executive Director (External) |

12/13 |

|

Kunio Tajiri |

Executive Director (External) |

13/13 |

|

Misao Kikuchi |

Executive Director (External) |

12/13 |

|

Koichiro Watanabe |

Executive Director (External) |

11/11 |

|

Shigeru Suzuki |

Standing Corporate Auditor |

13/13 |

|

Kosei Yonekawa |

Standing Corporate Auditor (External) |

2/2 |

|

Yukihito Mashimo |

Standing Corporate Auditor (External) |

11/11 |

|

Tatsuo Kainaka |

Corporate Auditor (External) |

13/13 |

|

Norio Saigusa |

Corporate Auditor (External) |

13/13 |

*1 In addition to the above number of Board of Directors meetings held, there were two resolutions made in writing, which were deemed to constitute Board of Directors meetings based on the provisions of the Companies Act and the Articles of Incorporation.

*2 The attendance status of Standing Corporate Auditor Kousei Yonekawa pertains to the period before his retirement on June 27, 2024.

*3 The attendance status of Executive Director Koichiro Watanabe and Standing Corporate Auditor Yukihito Mashimo pertains to the period after their appointment on June 27, 2024.

Related information

-

Corporate Governance Report

(1,004KB)

Corporate Governance Report

(1,004KB)