We have announced 2035 Long-term Management Strategy on April 28, 2025.

As a pioneer in the creation of happiness,

achieve what the Group aspires to be and contribute to society

Bringing more “Happiness” to you and the community.

To maintain alignment with Our Goal for 2030 and strengthen our initiatives for the future, we have formulated Our Goal for 2035 by evolving the existing concept

|

What the OLC Group aspires to be |

|

・Provide enjoyment that drives people into tomorrow through spaces and times where diverse people can share joy, laughter, and inspiration ・Cherish the world that nurtures and sustains us, and contribute to a sustainable society ・Continue to be a corporation in which employees can truly take pride by expanding the OLC Group's corporate value |

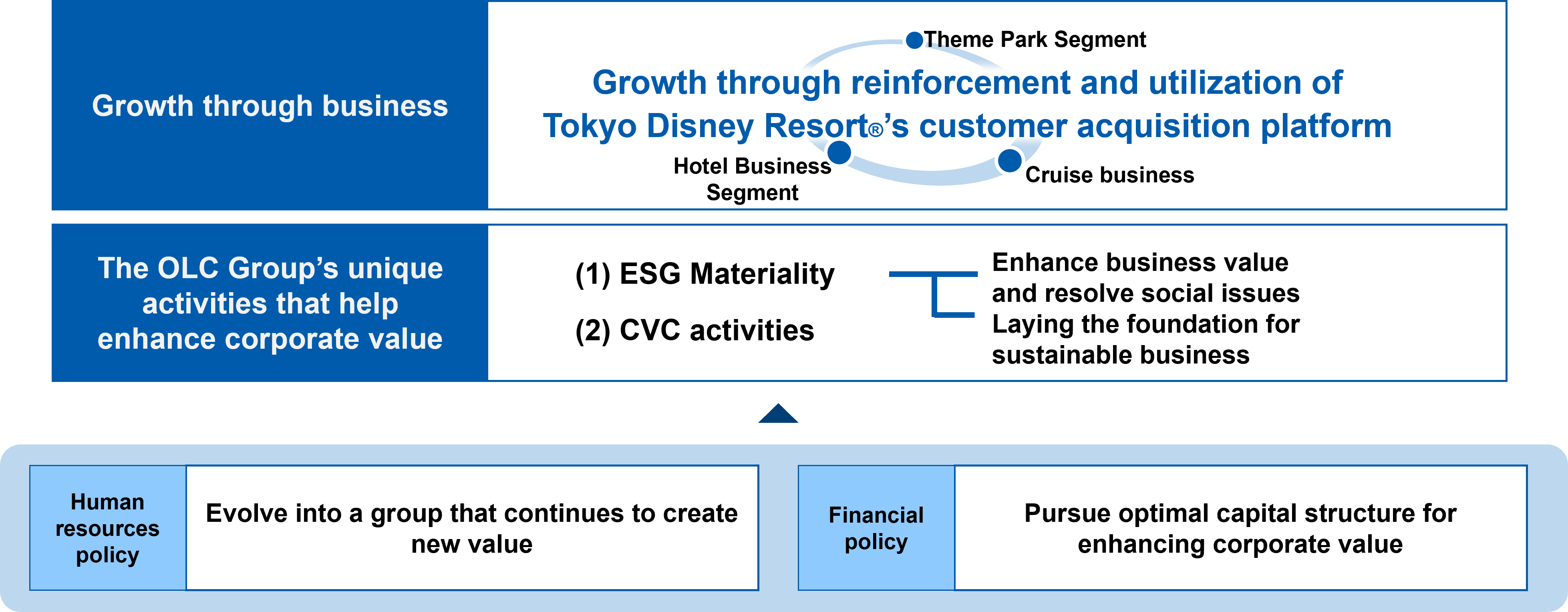

Promote our Long-term Management Strategy with the aim of further developing and evolving our Group, and achieve financial targets

Growth investment

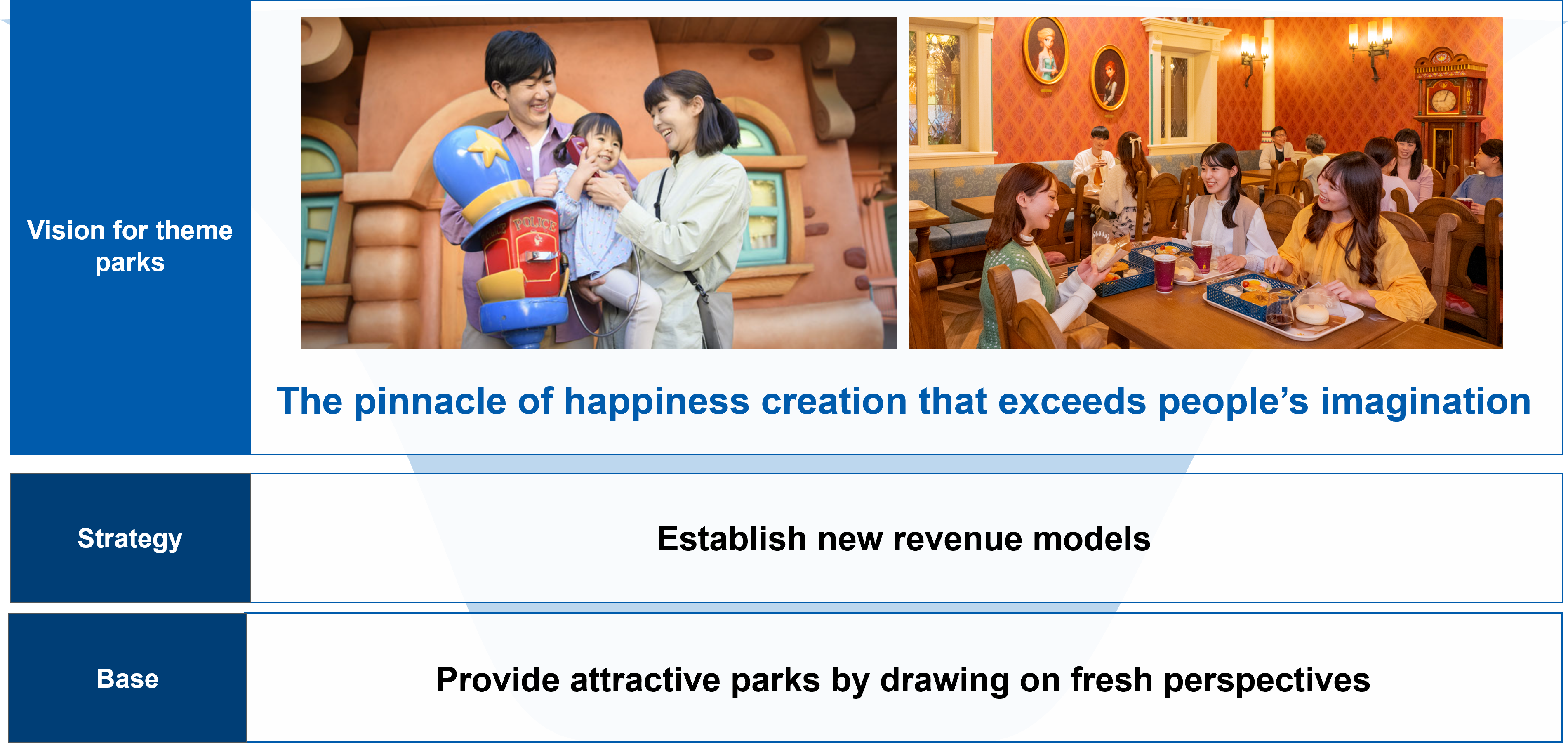

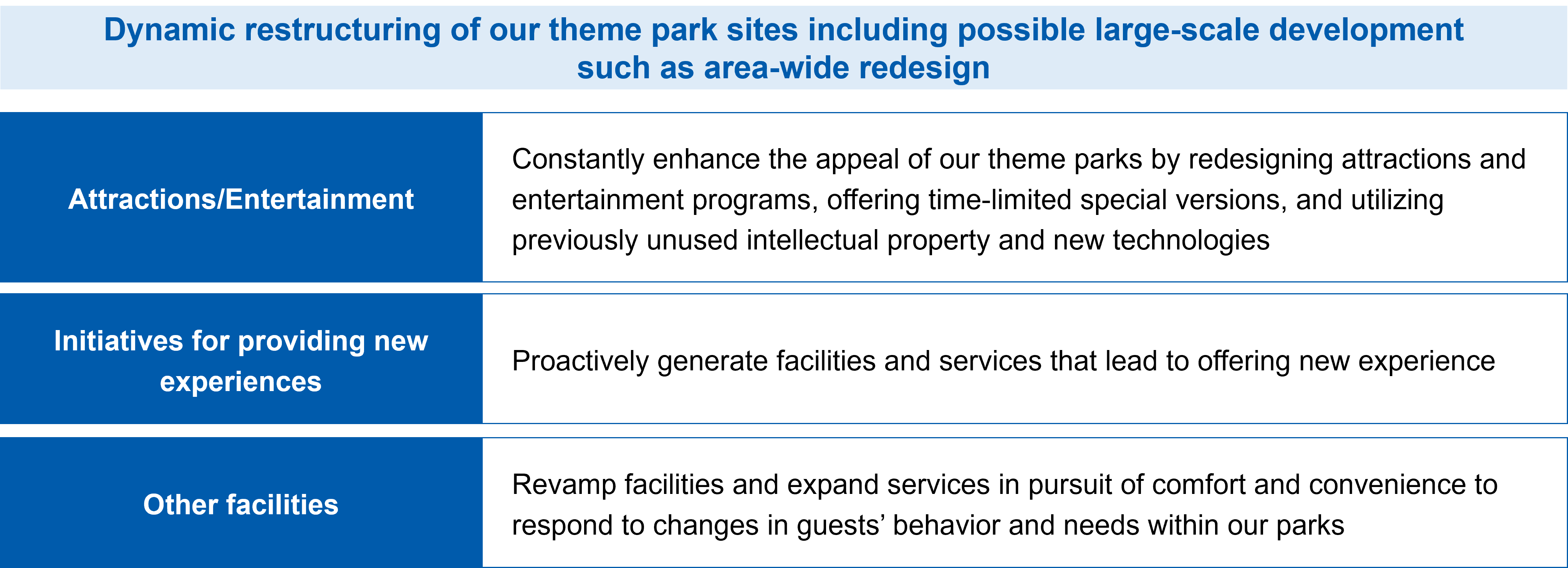

Theme park development policy ahead

Provide moving experiences and surprises that cannot be found anywhere else

in the world through development unique to Tokyo Disney Resort

Attraction set in the world of Wreck-It Ralph

Artist Concept Only

|

Investment amount |

\29.5 billion |

|

Scheduled opening |

Spring 2027 |

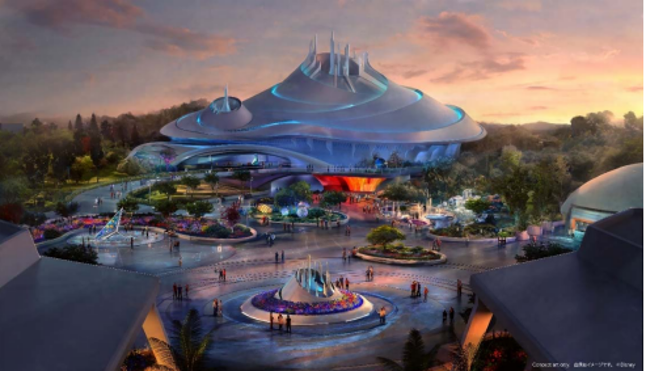

Development of entire area surrounding Space Mountain

Artist Concept Only

|

Investment amount |

\70.5 billion |

|

Scheduled opening |

2027 |

Artist Concept Only

Artist Concept Only

|

Attendance |

Establish a solid customer acquisition platform to achieve even higher attendance |

|

Net sales per guest |

Adapt to guests’ diverse needs and upgrade existing services |

|

New revenue sources |

Establish new revenue models for the Theme Park Segment that allow us to respond flexibly to changes in the external environment |

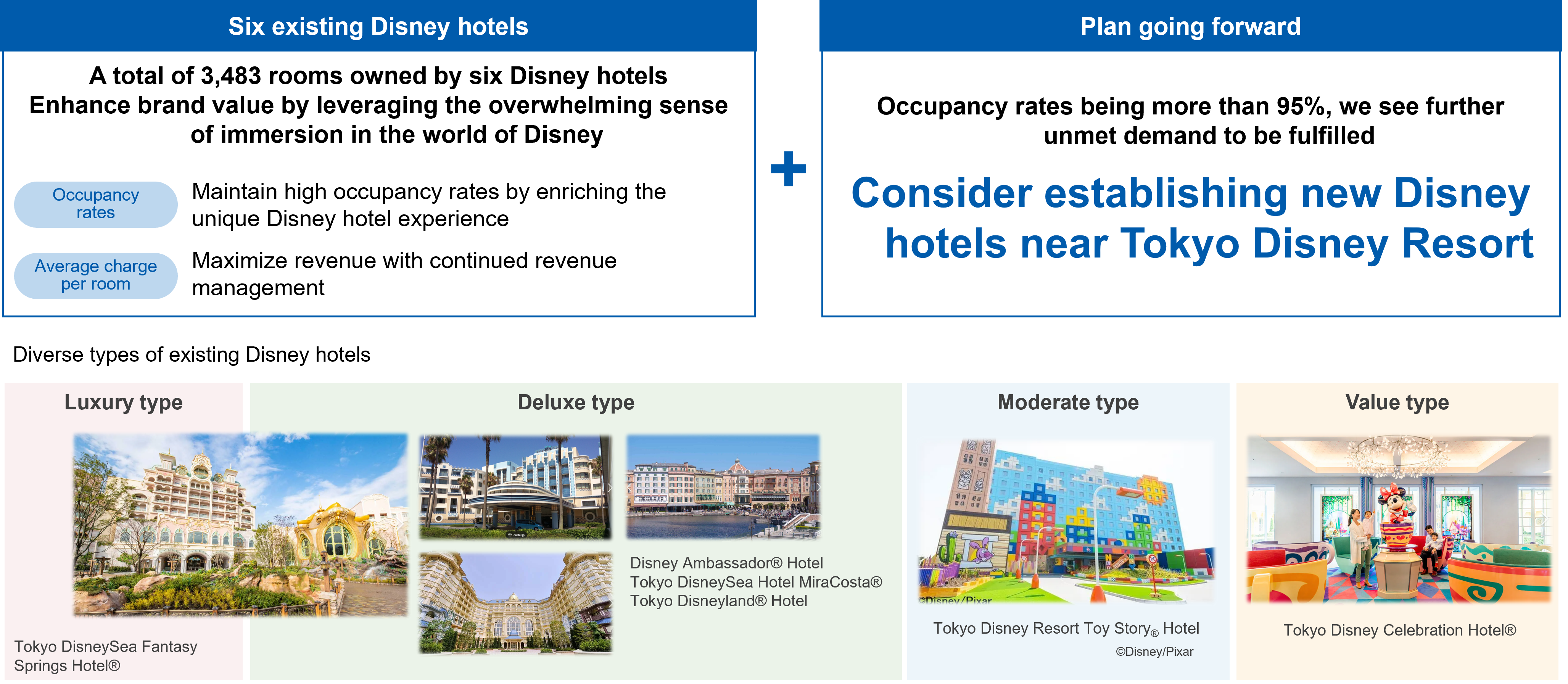

Maximize revenue through revenue management and consider establishing new Disney hotels

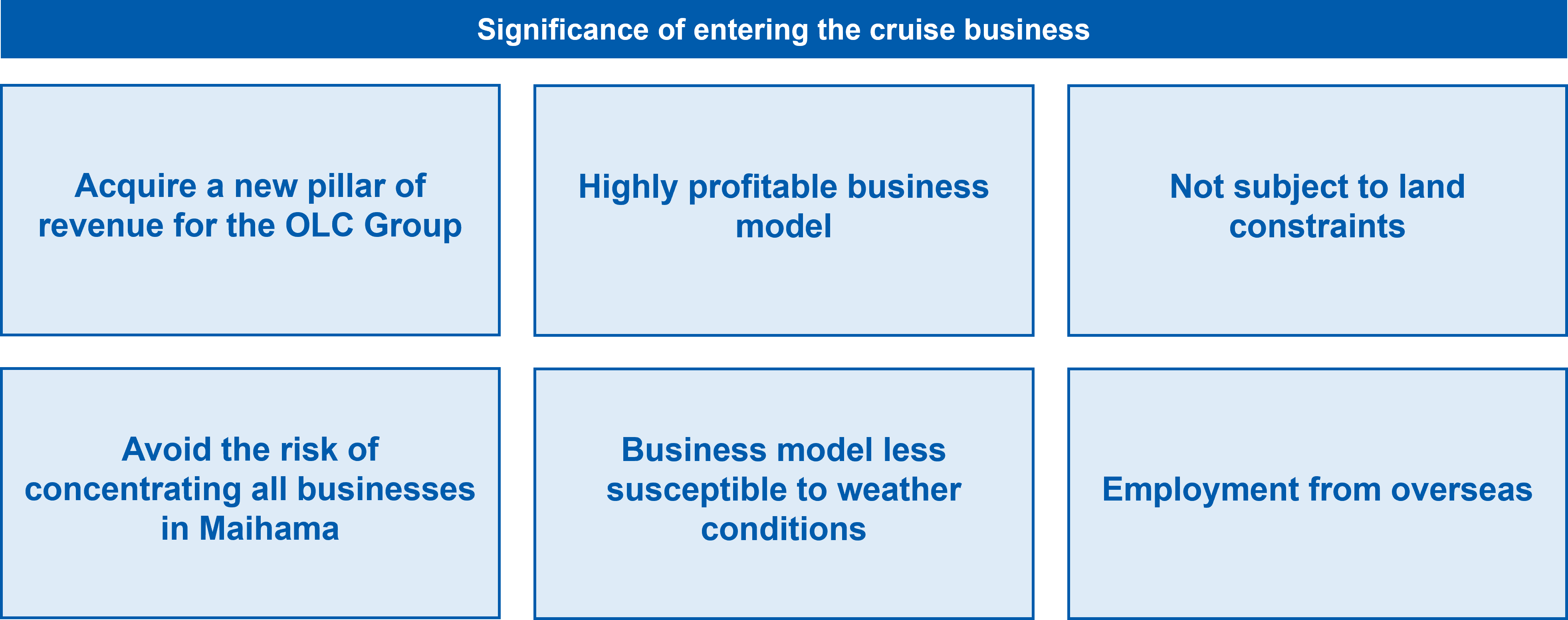

Build a new pillar of growth by entering the cruise business,

which has strengths not found in our existing businesses

|

Agreement with Disney Enterprises, Inc |

・Oriental Land has the rights pertaining to the development and operation of the Japan-based Disney cruises ・Contract period can be extended up to a period of 39 years from start of service ・Royalty* to be paid in accordance with net sales |

|

Services to be offered |

・Highly original Disney activities and entertainment aboard the ship ・Guest rooms of a variety of grades and types; Diverse dining options ・Hospitable services, etc. |

|

Scheduled start of services |

FY3/29 |

Investment value |

Ship’s body: \290 billion / Contingency funds: \40 billion |

||||

|

Registry |

Japan (planned) |

Ship design |

Designed based on "Disney Wish" cruise ship that started service in 2022 |

||||

| Tonnage | Approx. 140,000 gross tons | Number of guest rooms |

Approx. |

Capacity | Approx. 4,000 persons | Number of crew | Approx. 1,500 persons |

A.Cruise services planned at this point point

|

Route |

Cruises mainly depart and arrive at ports around Tokyo metropolitan area |

|

Length of cruise |

2 to 4-night short-term cruises |

|

Price per person |

A wide range of prices from the ¥100,000 range to ¥300,000 range* (one cruise per person) *Price for the most common type of guest room |

|

Target |

Families, younger generation, overseas inbound travelers |

|

Contribution to financial performance |

●Annual net sales and number of passengers are expected to reach approx. ¥100 billion and 400,000, respectively, within the first several years. Operating margin is estimated to be a level on a par with the Theme Park Segment. ●Annual depreciation and amortization expenses in the ¥20 billion range are expected. Statutory useful life of the ship is 15 years. ●Profit is assumed to be generated from FY2029 when full-year operation is scheduled ●We are closely examining the upside of net sales while aiming for the upper 20% range in operating margin within the first several years ●Operating margin is expected to improve further after depreciation ●A foreign exchange forward contract will be executed to hedge against exchange risks for approxmately half of the amount |

||

The launch of the second ship will be considered when the first ship is successfully on track.

We have restructured our ESG Materiality areas, and will implement initiatives in accordance with their respective standpoints and purposes

Investment fund limit is increased from \3 billion to \13 billion to accelerate activities aimed at creating new businesses that contribute to offering “wonderful dreams, moving experiences, happiness and contentment,” which is the OLC Group’s business mission

Strengthen business competitiveness by strengthening our talent base

capable of creating value and securing more human resources

Pursue an optimal capital structure to enhance corporate value with the aim of

achieving an even higher ROE than the level achieved under the 2024 Medium-term Plan

Take steady actions to increase corporate value, including agile share repurchases,

while prioritizing cash allocation to growth investment

- We will calculate our capital cost* and utilize the outcome to evaluate the return on capital and to make investment decisions

*Capital Cost: calculated based on our equity cost, which is calculated using CAPM - We are aware that our ROE keeps exceeding our equity cost

- Our price-to-book ratio [PBR] exceeds 1. We are aware that the market expects growth potential; on the other hand, PBR decreased from FY2023 due to a fall in our stock price

- ROE for FY2025 is projected to be 11.1%, exceeding equity cost

|

FY2022 |

FY2023 |

FY2024 |

|

|

ROE |

10.2% |

13.5% |

12.9% |

|

Equity cost |

4.3% |

5.1% |

6.6% |

|

Increase future cash flow and future profit |

・Aim to grow profits not only by strengthening and leveraging the ability of Tokyo Disney Resort to bring in customers but also by entering the cruise business |

|

Reduce capital cost |

・Make growth investments and conduct share repurchase by utilizing cash reserves* and debt repayment capacity in addition to operating cash flow *Cash reserve that can be used for growth investment and capital expenditure ・Promote sustainability management and strengthen investor relations activities ・Aim to increase dividend payout ratio to 30% by 2035 ・Stay aware of the issue of overhang and take the best possible action by identifying the situation with a release of the Company’s shares in advance |